Sustainability Gap Index 2023: Greenwashing vs Greenhushing

The inaugural report on the conflict between sustainability perceptions and performance

Brand Finance Sustainability Gap Index 2023: Greenwashing vs Greenhushing

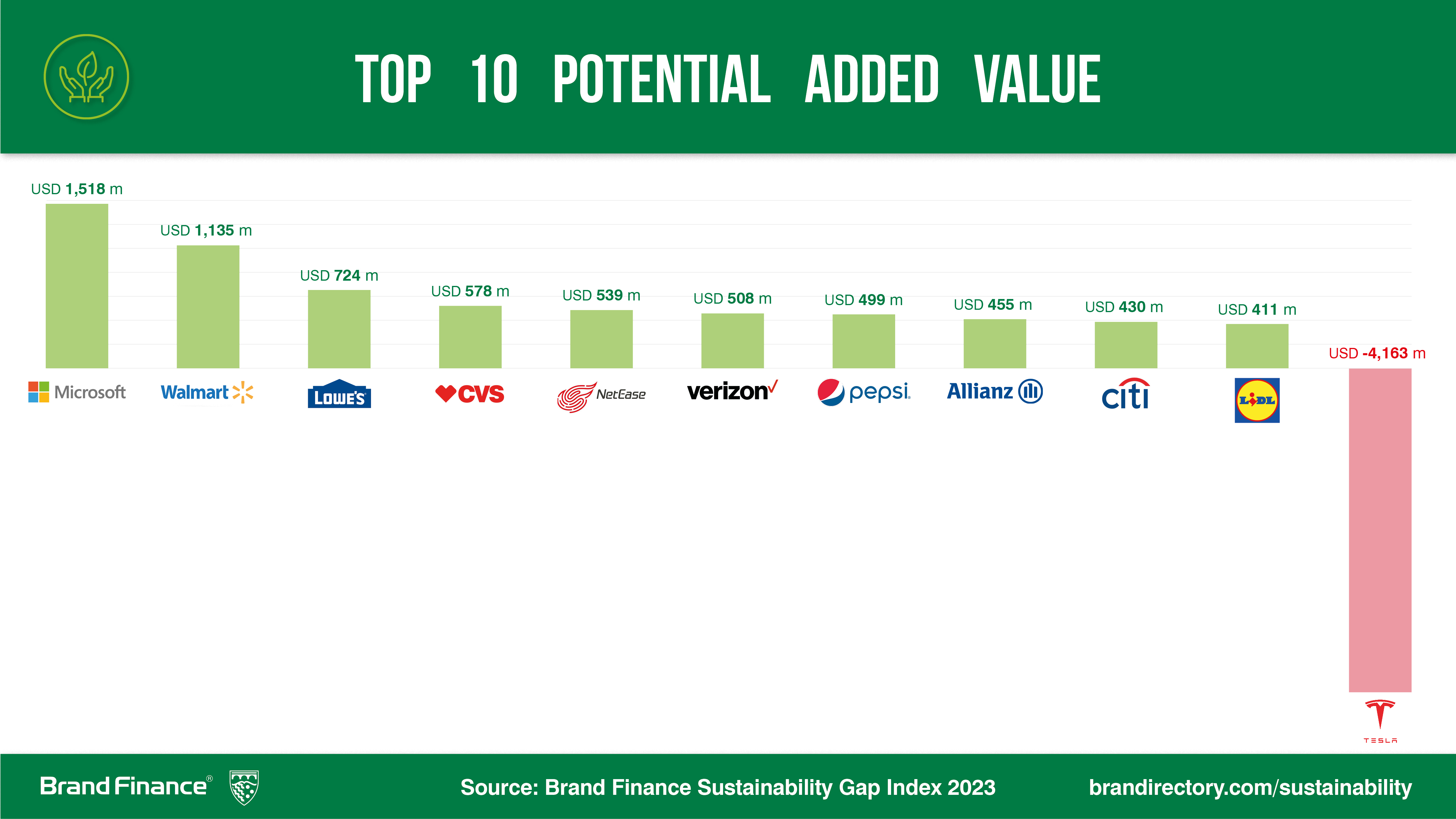

Billions at risk for the world’s largest brands if sustainability perceptions are not aligned with actual sustainability performance

- New Study reveals that for many brands value is either at risk or untapped by not aligning sustainability perceptions with actual performance

- Tesla has more than US$4.1 billion at risk, more than any other brand in the table

- Microsoft has the highest positive gap value of any brand according to Brand Finance’s research - USD1.5 billion

- Chanel shows how brands can better align sustainability performance with sustainability perception

New research reveals that many of the world’s largest brands have value at imminent risk if sustainability perceptions of stakeholders are not aligned with sustainability performance, according to leading brand valuation consultancy, Brand Finance. First launched at the World Economic Forum in Davos earlier this year, The Sustainability Perceptions Index showed that for many of the world’s most valuable businesses, there can be billions of dollars of financial value to be gained from enhanced ESG action and associated communication.

Brand Finance has now recalculated the valuations of each brand by considering their ESG performance, utilising data from CSRHub. The newly derived values, in conjunction with the Sustainability Perceptions Scores (SPS) disclosed in the latest Sustainability Gap Index report, expose whether the public perceptions align with the actual performance of each brand.

Robert Haigh, Strategy & Sustainability Director, Brand Finance commented:

“Our research found that where performance exceeds perception, there is an opportunity to rapidly generate value, by communicating the brand’s genuine commitment to sustainability more effectively. Conversely, where perception exceeds performance, value is at imminent risk, as brands leave themselves open to public backlash and a ‘correction’ of their sustainability perceptions value.”

Tesla, perhaps surprisingly, is one such brand. Known as a pioneer of the electric vehicles and battery technology, Tesla’s image has clearly carried across into the perceptions held by global consumers. Tesla has the highest proportion of value underpinned by sustainability perceptions of any brand (26.9%) resulting in a Sustainability Perceptions Value of US$17.8 billion. However, the strength of this perception creates its own risk, because whilst Tesla performs well on environmental components of sustainability, it is weaker on governance and measures of social sustainability. Tesla’s weaker CSRHub scores therefore create a value at risk of up to US$4.1 billion, more than any other brand in the table.

Conversely, Microsoft has the highest positive gap value of any brand according to Brand Finance’s research - USD1.5 billion. This reveals that Microsoft’s sustainability performance exceeds its sustainability perception; meaning there is an opportunity for Microsoft to generate up to US$1.5 billion through enhanced communication of its sustainability initiatives and services.

Conversely, Microsoft has the highest positive gap value of any brand according to Brand Finance’s research - USD1.5 billion. This reveals that Microsoft’s sustainability performance exceeds its sustainability perception; meaning there is an opportunity for Microsoft to generate up to US$1.5 billion through enhanced communication of its sustainability initiatives and services.

Luxury fashion house Chanel is an example of a brand that has both a (relatively) high Sustainability Perceptions Score (4.88/10) and a high CSRHub score. By engaging with a wide range of stakeholder groups, Chanel can better align its sustainability performance with its sustainability perception, based on strong, authentic sustainability communication.

Download the full report to find out more about the conflict between sustainability perceptions and performance...